3 Easy Facts About SR22 Insurance GA - What You Need to Know - Car and Driver Described

SR-22 Car Insurance: A Guide (With Quotes, Updated March Fundamentals Explained

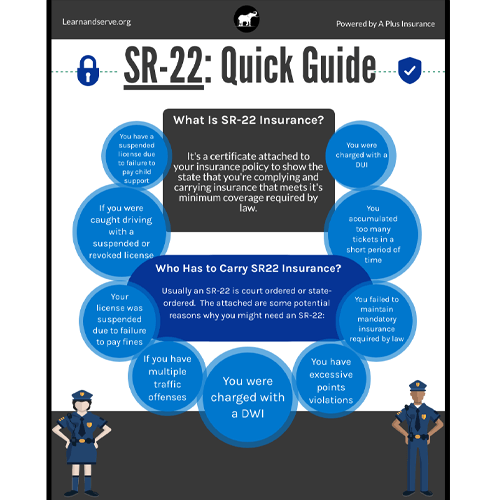

What is an SR-22? An SR-22 is a certificate of financial duty required for some motorists by their state or court order. I Found This Interesting -22 is not a real "type" of insurance, but a type submitted with your state. This kind acts as proof your automobile insurance coverage meets the minimum liability protection required by state law.

Do I need an SR-22/ FR-44? Not everyone requires an SR-22/ FR-44. Regulations differ from one state to another. Normally, it is required by the court or mandated by the state only for specific driving-related infractions. For instance: DUI convictions Negligent driving Accidents triggered by uninsured chauffeurs If you require an SR-22/ FR-44, the courts or your state Automobile Department will alert you.

When you continue to buy a policy, make certain to address "Yes" to the question "Need a Certificate of Financial Duty or SR-22?". After purchase we will begin the procedure of submitting an SR-22 or FR-44 certificate on your behalf. We'll call you if we require any additional information to complete the request.

Find About SR-22 Insurance and Forms - Intoxalock

Rumored Buzz on SR-22 Insurance Certificate (Financial Responsibility for the

Existing Consumers can contact our Client Service Department at ( 877) 206-0215. We will examine the protections on your policy and start the process of submitting the certificate on your behalf. Exists a cost related to an SR-22/ FR-44? Many states charge a flat fee, however others need an additional charge. This is a one-time charge you must pay when we file the SR-22/ FR-44.

Sr22 Form - Fill Out and Sign Printable PDF Template - signNow

A filing charge is charged for each specific SR-22/ FR-44 we submit. For example, if your spouse is on your policy and both of you require an SR-22/ FR-44, then the filing cost will be charged twice. Please note: The charge is not included in the rate quote due to the fact that the filing cost can vary.

How long is the SR-22/ FR-44 legitimate? Your SR-22/ FR-44 needs to stand as long as your insurance policy is active. If your insurance coverage policy is canceled while you're still required to carry an SR-22/ FR-44, we are needed to notify the proper state authorities. If you do not preserve constant coverage you could lose your driving opportunities.

The Facts About Florida SR-22 Non-Owner Insurance - License Reinstatement Uncovered

California DUI Lawyers DUI Laws & Penalties SR22 Requirements SR22 Requirements.